Is the United States currency about to undergo significant change? Are you ready?

PRAY FIRST for God to be at work in the hearts and minds of federal leaders as they look to the future of American currency.

You may have heard the commercial asking, “What’s in your wallet?” If you are used to reaching for the federally-issued greenback, you might soon be surprised!

A Reuters March report said the U.S. money supply is falling at the fastest rate since the 1930s, a “red flag” for the economy and financial markets.

It Costs Money to Make Money

2023 is coming to a close, and the Federal Reserve has spent $931.4 million to print paper currency. So where’s the problem?

A senior economics fellow at the Brookings Institute recently said, “We haven’t modernized or changed our currency. That’s probably a mistake. We should have dollar coins instead of paper notes.”

The curator and director of the American Numismatic Association said, “The rest of the world has moved toward basically polymer notes, which are a form of plastic which lasts something like four times as long as old paper notes.”

It costs money to print money. Variables such as paper, ink, labor, and direct overhead costs go into what it costs to print a federal note. And they aren’t all the same. $1 and $2 bills cost 2.8 cents per note; a $10 bill is 4.8 cents, and a $100 bill costs 8.6 cents per note.

Minting coins is another thing altogether. A penny costs 2.72 cents to make in 2022; a nickel costs 10.41 cents. Other coins cost less than their face value.

The “life span” of an average $1 bill is 4.8 years; less for a $5 bill and even less for a $10.

According to information from the Federal Reserve, approximately 14 billion $1 bills are currently in circulation, and more than 17.7 billion are $100s.

Is the dollar doomed? Will cash soon be obsolete? Is America ready for such a change?

What About Cryptocurrency?

In March 2022, President Joe Biden signed an executive order on “Ensuring Responsible Development of Digital Assets.” The White House took steps to say there is no plan to convert the U.S. dollar to cryptocurrency, but they wanted to evaluate its risks and benefits to consumers and the economy.

However, postings online included the claim: “Breaking news! President Joe Biden unveils Executive Order EO-14067, a groundbreaking move that transforms the US Dollar into a cryptocurrency. This announcement has profound implications for the financial landscape.”

Later in June, President Biden, in a speech on “Bidenomics,” said he wanted to eliminate loopholes for crypto traders. Again, the White House reassured the public, saying, “There are no plans to convert the U.S. dollar into a digital asset.”

A vice president of the Federal Reserve said that crypto tokens are unlikely to replace traditional currency and that banks should proceed cautiously when they experiment with the asset class.

An article in ALTCOINBuzz, a website that focuses on cryptocurrency, concluded that a hypothetical scenario of converting the U.S. dollar and other global currencies to something like Bitcoin “serves as a reminder of the complex interplay between technology, economics, and governance in our ever-evolving global financial landscape.”

International Investors May See Things Differently

The digital currency market is heavily influenced by international traders and investment counselors. BlackRock, one of the world’s leading investment, advisory, and risk management solutions providers, has indirectly entered the cryptocurrency fray.

While claiming they do not directly invest in digital assets, they recently filed documents with regulatory bodies for a spot Ethereum [digital money] exchange-traded fund (ETF), in what some see as a clear doubling down on its cryptocurrency bets amid investor optimism about the approval of such investment vehicles.

Reuters said, “BlackRock dipped its toes in the crypto space with its filing for a spot bitcoin ETF in June. Its latest filing indicates that the Wall Street behemoth is aiming to move beyond bitcoin, the world’s most popular cryptocurrency.”

Cryptocurrency News says BlackRock’s views are vital for Bitcoin as it becomes more accessible.

On Thursday, BlackRock filed for a spot in Ethereum ETF. If approved, it will be listed on the Nasdaq as the IShares Ethereum Trust, giving investors access to the cryptocurrency without owning it directly. Approval by the SEC is anticipated, according to watcher.guru.

But there are skeptics. Analysts at J.P. Morgan published a report calling the recent surge in crypto “overdone.” They argued that an ETF approval would only serve to redistribute capital that traders have already put into the industry, not that it would attract new investment.

Is BRICS forcing the change?

For centuries, the U.S. dollar has been the king of global trade, not only because America has had the strongest world economy since the end of World War II but also because of oil. The petrodollar was based on the price of the American greenback.

But global commodity trading is changing. International Monetary Fund reports show the dollar remains dominant, but for how long?

Earlier this year, a number of American trading partners, dissatisfied with inflation in the U.S. and the potential for a recession that would reduce the value of the dollar further, gathered in South Africa to talk of de-dollarization of world trade.

Known as BRICS—for Brazil, Russia, India, China, and South Africa, they asked, “Why will countries have to base their trade on the dollar?” But they also felt competitors like the euro, yen, and yuan held their own problems. One economist said, “Europe is a museum, Japan is a nursing home, and China is a jail.”

A writer for Foreign Policy said, “He’s not wrong. But a BRICS-issued currency would be different. It’d be like a new union of up-and-coming discontents who, on the scale of GDP, now collectively outweigh not only the reigning hegemon, the United States, but the entire G-7 weight class put together.”

Most economists agree a BRICS currency might one day dethrone the dollar, but it will be an uphill climb.

A senior visiting fellow at the London School of Economics, Shirley Ze Yu, said, “Creating the BRICS currency will require a set of institutions. Institutional creation requires a common set of standards and underpinning values. These are very difficult to achieve, although not impossible.”

In September, Treasury Secretary Janet Yellen said that de-dollarization may be at hand as the dollar saw an 8% decline in its stance globally since 2022. Yet, she said, “it will not be easy for any country to devise a way to get around the dollar.”

A BRICS currency may be in the future, but most agree that that future is still a long way off.

Return to Gold for the Sake of National Security?

Before 1971, the United States was on various forms of a gold standard. The dollar’s value was backed by gold reserves, and paper money could be redeemed for gold on demand. Since then, the U.S. was removed from the gold standard, not by Congress but by an executive order of President Richard Nixon, in part to reduce inflation and expand job growth.

Since 1971, the dollar has had a fiat currency backed by the “full faith and credit” of the government, not by any wealth or value in gold, and not convertible to anything but more of the same.

Those who favor a return to the gold standard argue that gold retains a stable value, reducing risks from economic crises. It also serves to limit the power of government and would reduce the U.S. trade deficit. Some have suggested it could prevent unnecessary wars by limiting defense spending.

Opponents argue that gold is volatile, that the economy would be destabilized by removing economic and military intervention by governments, and that it would increase environmental and cultural harms by mining industries.

CONCLUSION

Fears of a drop in the circulation of U.S. currency are unfounded. The latest report. For the week ending November 8, 2023, shows U.S. currency in circulation is at a current level of 2.326 trillion, up from the prior week and up from a year ago.

For now, what is in your wallet is safe from immediate change to another currency. Changes in its value based on inflation is another story. But keep an eye on things as the government can make changes overnight!

HOW THEN SHOULD WE PRAY:

— Pray that Congress would show greater wisdom in their handling of government finances. “One who is faithful in a very little is also faithful in much, and the one who is dishonest in a very little is also dishonest in much” (Luke 16:10).

— Pray that as you deal with your own funds, you do so wisely. “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty” (Proverbs 21:5).

CONSIDER THESE ITEMS FOR PRAYER:

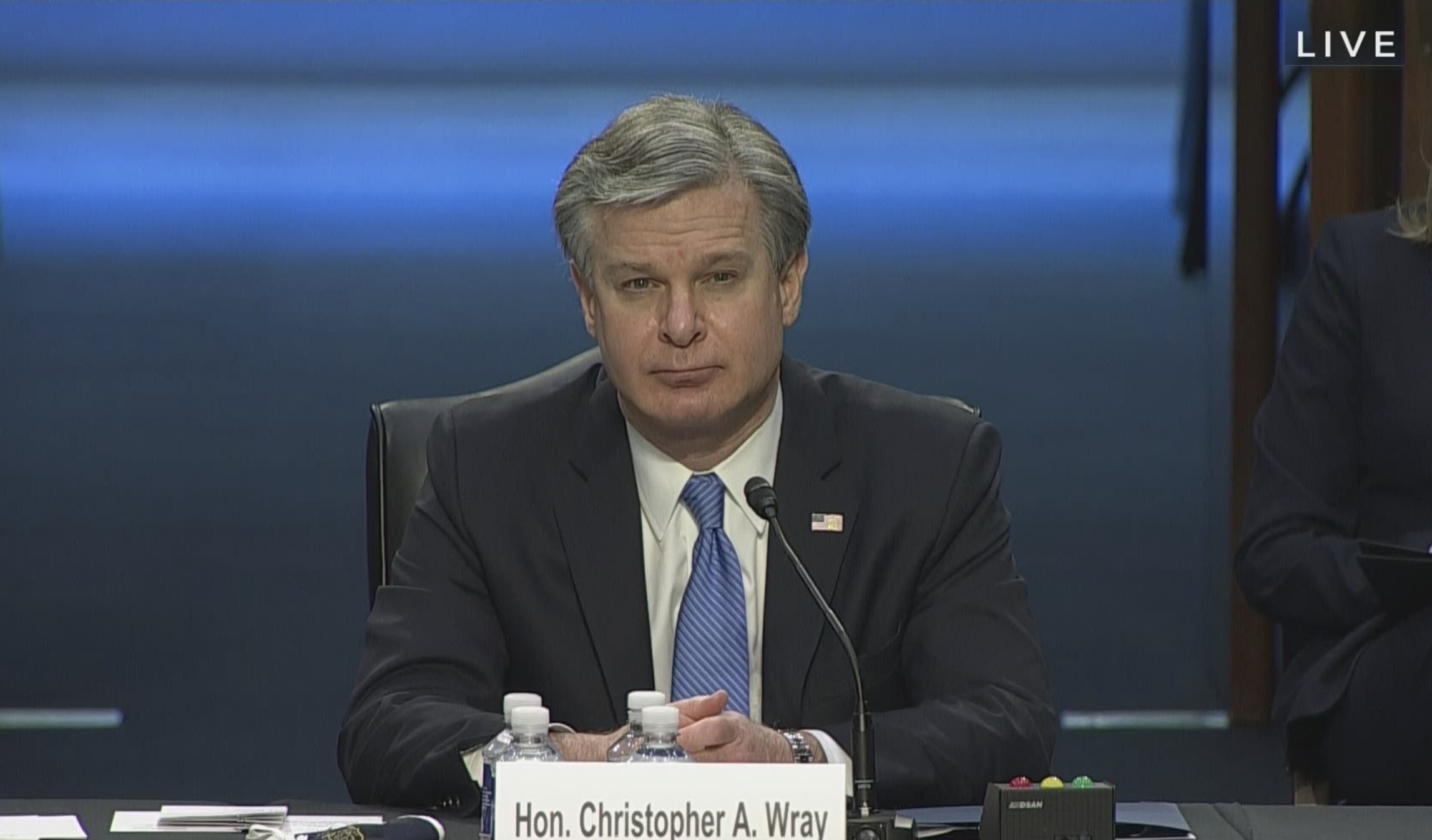

- Pray for Treasury Secretary Janet Yellen and those who work with her on maintaining sound fiscal policies.

- Pray for the members of the Federal Reserve as they keep watch over the nation’s monetary policies.

- Pray about your own financial responsibilities to others. “Honor the Lord with your wealth” (Proverbs 3:9).

Sources: Reuters, CNBC, Federal Reserve, Bloomberg, Coin News, Blackrock, New York Times, Watcher.guru, ForeignPolicy.com, Al Jazeera, Money Wise