The director says, “Medical bills have little predictive value in credit decisions.“

The Consumer Financial Protection Bureau (CFPB) is in the rulemaking process that would take medical bills off of credit reports. The proposal is intended to assist those who have had medical crises recover, end the practice of the collection of debts that may not be owed, and ensure creditors have better and more accurate data on consumers.

The bureau reports that, in 2022, approximately 20 percent of Americans owed medical debt. Under the Fair Credit Reporting Act, creditors are not allowed to use medical information in underwriting decisions. However, an exception made in 2006 allowed such data if it were characterized as “financial information.“

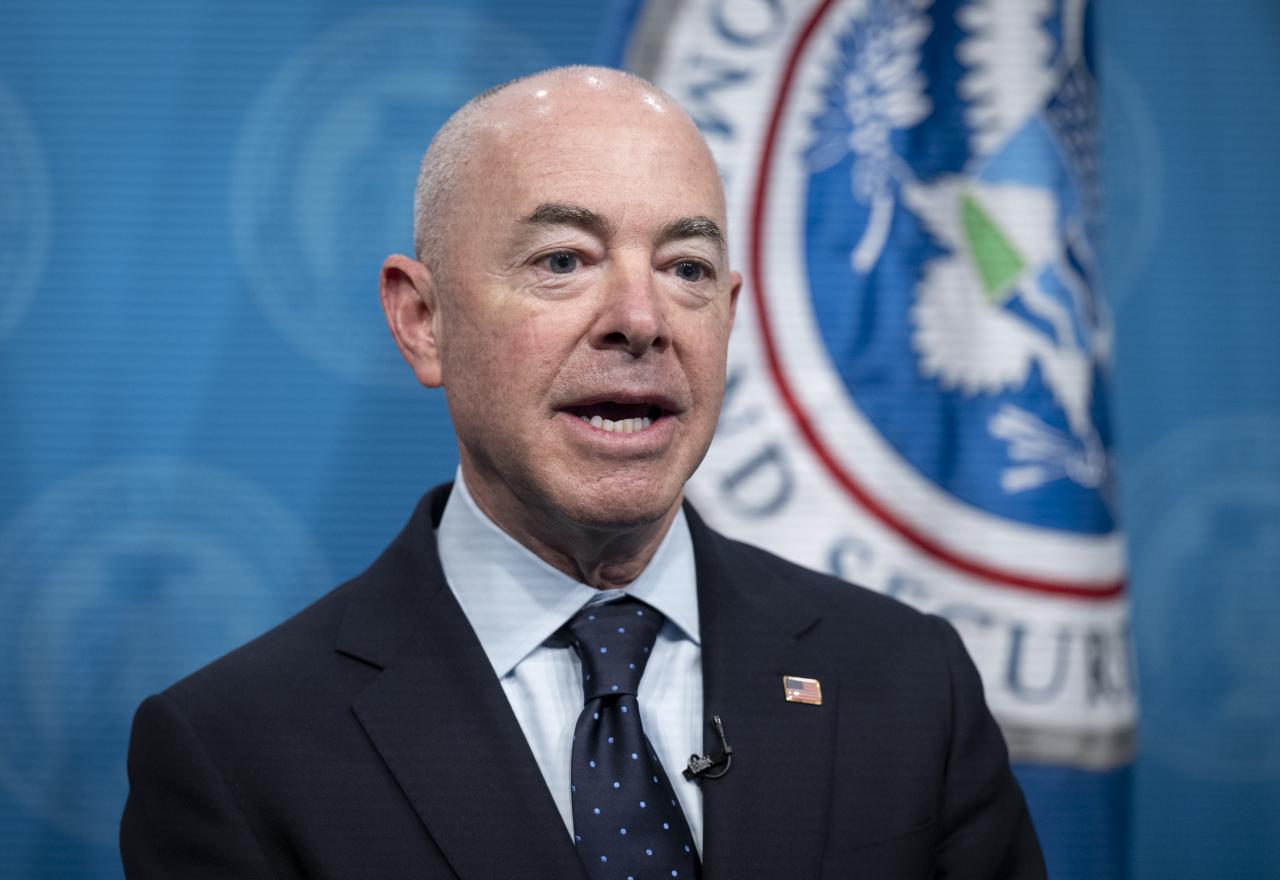

“Research shows that medical bills have little predictive value in credit decisions. Yet tens of millions of households are dealing with medical debt on their credit reports,” said Director Rohit Chopra. “When someone gets sick, they should be able to focus on getting better, rather than fighting debt collectors trying to extort them into paying bills they may not even owe.”

As the Lord Leads, Pray with Us…

- For Director Chopra to seek God’s wisdom as he heads the CFPB.

- For U.S. credit officials and the public as they provide input on the rule that would eliminate medical bills from credit reports.

Sources: Consumer Financial Protection Bureau