Tax would be on “excess profits.”

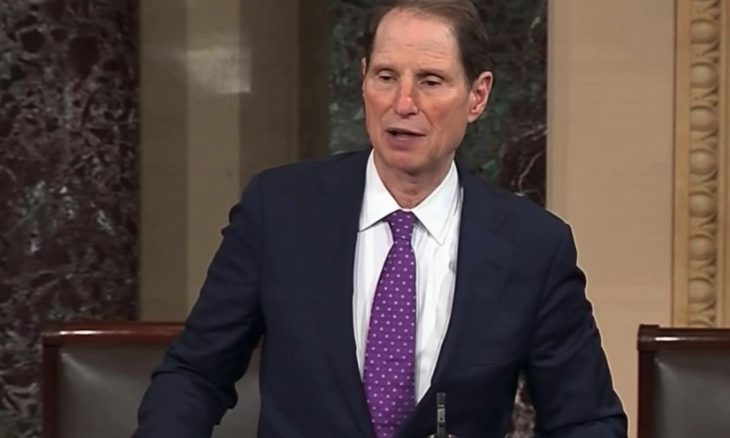

Senator Ron Wyden of Oregon is introducing the Taxing Big Oil Profits Act, which he says will accentuate the tax burden of oil and gas companies taking in more than $1 Billion per year—perhaps even double it. He said the legislation would call for a 21 percent tax on the “excess profits” of oil and gas companies eclipsing the $1 billion threshold of earnings.

The definition of “excess profits” from the senator’s perspective: current profits minus a standard 10 percent return on investment. The secondary part of his bill, a 25 percent excise tax, would be assessed on all corporate stock purchased by the oil an gas companies.

“Our broken tax code is working for Big Oil, not American families. While Americans pay more to fill up their gas tanks, Big Oil companies are raking in record profits, rewarding their CEOs and wealthy shareholders with massive stock buybacks, and using special loopholes in the tax code to pay next to nothing in taxes,” said Senator Wyden, chairman of the Senate Finance Committee.

Senator Wyden said the bill is, in large part, an overhaul of the tax code which had traditionally favored the fossil fuel industries at the expense of investing in renewable energy.

“It takes the tax code and throws it in the trash can. No longer will the government be picking winners and losers and just giving out favors to the politically powerful,” he said. “For the first time, the more you reduce carbon emissions, the bigger the tax savings.”

As the Lord Leads, Pray with Us…

- For Senator Wyden and his colleagues as they consider measures to reduce the cost of fuel.

- For wisdom for federal legislators as they evaluate and assess the oil industry and its profitability.

Sources: The Hill, Oregon Capital Chronicle, Newsmax