Congress makes adjustments for individuals 65 and over, and for Social Security beneficiaries. Congress enacted two laws this year, President Donald Trump’s “One Big Beautiful Bill” and the…

Read MoreTax

Treasury Secretary Responds to Governors Blocking Tax Cuts

He calls the block “political obstruction.” Treasury Secretary Scott Bessent responded to the refusal of the governors of the states of New York, Colorado, Illinois, and the District…

Read MoreIRS Releases Guidance for Tax Deductions on Tips and Overtime

Workers who received tips or overtime will be able to deduct this compensation when filing their 2025 income taxes. The Internal Revenue Service (IRS) has released guidance on its “no…

Read MorePresident Proposes Tariff Increase over Foreign Taxes on U.S. Tech Companies

He called the taxation of companies like Google and Meta “discriminatory actions.” President Donald Trump warned that he would impose new tariffs against countries that tax or regulate…

Read MoreSenate Passes President’s “Big, Beautiful Bill”

Vice President Vance voted to break the 50-50 tie. Vice President JD Vance voted to break the 50-50 Senate tie to pass President Donald Trump’s “One, Big, Beautiful…

Read MoreCongress Nears Deadline to Pass President’s Agenda Legislation

President Trump urged legislators to approve it by July 4 or delay their recess. The majority in Congress are nearing the original deadline of July 4 that was…

Read MoreSenate Negotiates “Big Beautiful Bill”

Majority Leader Thune working to maintain a majority to pass the legislation in the upper chamber. The “Big, Beautiful Bill” being negotiated by Congress was sent to the…

Read MoreSupreme Court Grants DOGE Access to Social Security Data Systems

The majority said there is no evidence that DOGE would mishandle data. The Supreme Court ruled last week that the Department of Government Efficiency (DOGE) may be allowed…

Read MoreHouse Majority Addresses Tax Policies in Reconciliation

The proposal includes no tax on tips and remittance tax for dollars flowing out of the country. The House majority released their massive budgetary proposal on Monday, outlining…

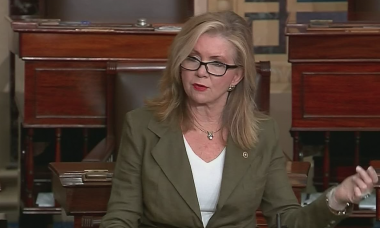

Read MoreSenator Proposes Legislation to Strengthen Social Security

The bill would raise the income threshold on which Social Security recipients pay taxes. U.S. Senator Marsha Blackburn of Tennessee has proposed the Retirees First Act, which would…

Read More