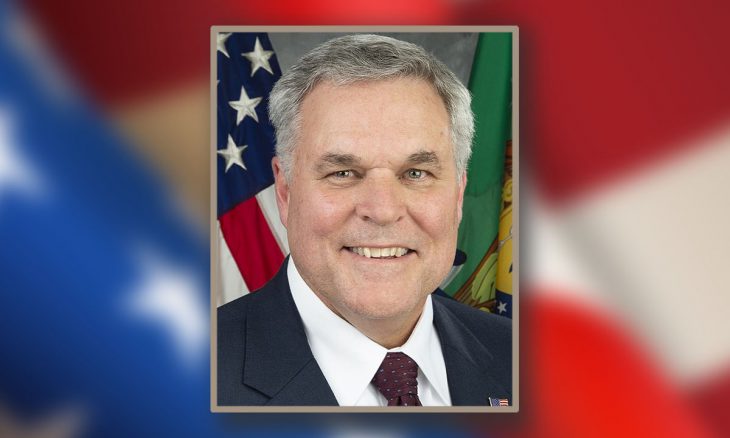

Charles Rettig

Commissioner, Internal Revenue Service

Charles Paul Rettig was born in November 1956 in Los Angeles, California. He earned an undergraduate degree in economics from University of California, Los Angeles, a Juris Doctor from the Pepperdine University School of Law, and an L.L.M. in Taxation at the New York University School of Law.

He spent 38 years in the private practice of law in Beverly Hills, holding leadership roles in a number of professional organizations. He was appointed by the IRS to serve as Chairman of the IRS Advisory Council, serving one year.

He was nominated by President Trump to be Commissioner of the Internal Revenue Service. His nomination was confirmed by the full Senate and he assumed office in October 2018.

He is married to Tam Rettig and they have four children, including 2 stepsons.

In the News…

Internal Revenue Service Commissioner Charles Rettig sought congressional help in stopping land-rights deals that the government views as being abusive transactions.

He told a Senate subcommittee that so-called syndicated conservation easements have continued despite years of increased IRS enforcement that now includes guaranteed audits, attempts to assert civil fraud penalties, litigation, and criminal investigations.

In response to questions from Senator Chris Van Hollen of Maryland, the IRS commissioner said, “We’ve put a lot of resources into this space. We have not had an impact on essentially showing the volume of these transactions… We need congressional help. We need a statute to help us curb this activity.”

In a conservation easement, a landowner can claim an income tax deduction for donating development rights, typically to a nonprofit land trust. The syndicated deals created by promoters over the past decade use that basic structure, and they do create permanent restrictions on land use.

But IRS officials contend that those promoters often rely on inflated appraisals and assumptions about potential valuable development to assert that they are giving up much more in value than what the land may have recently sold for. In many cases, investors attempt to claim deductions exceeding four times what they spend, and those breaks are so large that they can make quick profits at public expense.

Contact this Leader…

Did you pray for Commissioner Rettig today? You can let him know at:

The Honorable Charles Rettig, Commissioner

Internal Revenue Service

1111 Constitution Ave. NW

Washington, DC 20224